# TL;DR

- Nvidia’s Milestones: Founded in 1993, IPO in 1999, introduced CUDA in 2006, pivoted to AI and data centers in the 2010s, controlled 80% of the GPU market by 2024.

- Financial Performance: Revenue up 262.12% year-on-year in Q1 2024, market cap surpassed $3 trillion in June 2024.

- Leadership Lessons from Jensen Huang:

- Embrace Failure: View setbacks as learning opportunities.

- Authentic Leadership: Foster trust and loyalty through genuineness.

- Continuous Innovation: Stay relevant and competitive.

- Collaborate to Win: Leverage partnerships for growth.

- Aim for Excellence: Strive to be the best in your field.

- AI Dominance: GPUs designed for parallel processing, CUDA revolutionized general-purpose computing, powering advanced AI applications.

- Competitive Landscape: Faces competition from AMD, Intel, and tech giants developing in-house AI chips, but remains dominant due to its innovation and market entrenchment.

- Resources Section: Detailed references on Nvidia’s market dominance, AI contributions, financial performance, and leadership insights from Jensen Huang.

# Introduction

Nvidia’s meteoric rise to a $3 trillion market cap is a testament to its innovative prowess, strategic leadership, and pivotal role in the AI revolution. This article explores Nvidia’s journey to this monumental valuation, the leadership lessons from its CEO Jensen Huang, and the unparalleled importance of Nvidia in the growth of AI. Additionally, we will examine Nvidia’s competitive landscape and how it continues to fare against its rivals.

# Nvidia’s Road to a $3 Trillion Market Cap

# The Genesis and Evolution

Founded in 1993 by Jensen Huang, Chris Malachowsky, and Curtis Priem, Nvidia started as a company focused on graphics processing units (GPUs) for gaming. Over the years, it has transformed into a tech behemoth, leading the charge in AI and high-performance computing.

Nvidia’s journey to a $3 trillion market cap has been marked by several key milestones:

- Initial Public Offering (IPO): Nvidia went public in 1999, raising $42 million. This move provided the capital needed to fuel its growth and innovation.

- CUDA and Parallel Processing: In 2006, Nvidia introduced CUDA, a parallel computing platform and programming model. This innovation allowed developers to harness the power of GPUs for general-purpose computing, laying the groundwork for AI applications.

- AI and Data Centers: Nvidia’s strategic pivot towards AI and data centers in the 2010s significantly boosted its revenue. The introduction of the A100 GPUs in 2020, designed specifically for AI workloads, marked a turning point.

- Market Dominance: By 2024, Nvidia controlled about 80% of the GPU market, with its AI accelerators holding between 70% and 95% of the AI chip market share.

# Financial Performance and Market Valuation

Nvidia’s financial performance has been nothing short of spectacular. In the first quarter of 2024, the company reported a revenue increase of 262.12% year-on-year, with net income growing by 628.39%. This impressive growth was driven by the soaring demand for its AI chips, particularly in data centers and AI applications.

In June 2024, Nvidia’s market cap surpassed $3 trillion, making it the third U.S. company to achieve this milestone, following Apple and Microsoft. This rapid ascent was fueled by a 27% rally in its stock price, driven by investor confidence in its AI capabilities and future growth prospects.

# Leadership Lessons from Jensen Huang for Solopreneurs

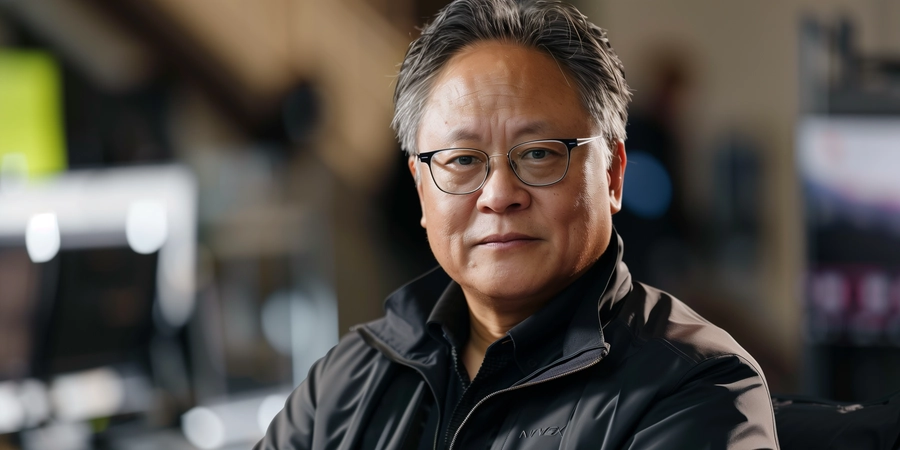

Jensen Huang, Nvidia’s co-founder and CEO, has been at the helm for nearly 30 years. His leadership style and strategic vision offer valuable lessons for solopreneurs and aspiring entrepreneurs.

# 1. Embrace Failure

Huang’s journey with Nvidia has been fraught with challenges and setbacks. Early in the company’s history, Nvidia faced near bankruptcy when its initial technology failed. Instead of succumbing to despair, Huang embraced failure as a learning opportunity. This culture of celebrating failure and learning from mistakes has been integral to Nvidia’s success.

Lesson for Solopreneurs: Embrace failure as a part of the entrepreneurial journey. Each setback is an opportunity to learn, innovate, and improve.

# 2. Develop an Authentic Leadership Style

Huang believes in authentic leadership. He emphasizes the importance of being genuine and honest in all interactions. This authenticity fosters trust and inspires teams to follow their leader with conviction.

Lesson for Solopreneurs: Be true to yourself and lead with authenticity. Genuine leadership builds trust and loyalty among your team and stakeholders.

# 3. Innovate Continuously

Nvidia’s success is built on relentless innovation. From the introduction of CUDA to the development of AI-specific GPUs, Nvidia has consistently pushed the boundaries of technology. Huang’s commitment to innovation has kept Nvidia at the forefront of the tech industry.

Lesson for Solopreneurs: Never stop innovating. In a rapidly changing world, continuous innovation is key to staying relevant and competitive.

# 4. Collaborate to Win

Huang understands the importance of collaboration. Nvidia has partnered with tech giants like Amazon, Google, and Microsoft, and has invested in startups to expand its capabilities and market reach.

Lesson for Solopreneurs: Collaborate with others to leverage their strengths and expand your reach. Strategic partnerships can open new opportunities and drive growth.

# 5. Aim to Be the Best

Huang’s vision for Nvidia has always been to be the best in the industry. This ambition has driven the company to achieve remarkable milestones and set new standards in technology.

Lesson for Solopreneurs: Set high standards and strive to be the best in your field. Ambition and excellence are key drivers of success.

# Nvidia’s Unmatched Role in AI Growth

Nvidia’s contribution to the AI revolution is unparalleled. Its GPUs, initially designed for gaming, have become the backbone of AI and high-performance computing.

# The Power of GPUs in AI

GPUs are designed to handle parallel processing, making them ideal for AI workloads that require processing vast amounts of data simultaneously. Nvidia’s GPUs, such as the A100 and H100, are specifically optimized for AI tasks, including deep learning, natural language processing, and image recognition.

# CUDA: The Game Changer

CUDA, introduced in 2006, revolutionized the use of GPUs for general-purpose computing. It provided the necessary infrastructure for AI functions, enabling researchers and developers to leverage the power of GPUs for AI applications.

# AI Applications and Impact

Nvidia’s GPUs power some of the most advanced AI applications, including OpenAI’s ChatGPT, autonomous vehicles, and scientific research. The versatility and performance of Nvidia’s GPUs have made them indispensable in various industries, driving significant productivity gains and cost savings.

# Economic and Industry Impact

Nvidia’s dominance in the AI market has far-reaching implications for the tech industry and the economy. The company’s innovative technologies have the potential to drive new applications and industries, creating new opportunities for businesses and jobs. The increasing adoption of AI solutions across various sectors is expected to lead to significant productivity gains and economic growth.

# Nvidia’s Competitors and Market Position

Despite its dominant position, Nvidia faces stiff competition from several key players in the tech industry.

# Advanced Micro Devices (AMD)

AMD is one of Nvidia’s primary competitors in the GPU market. AMD’s Instinct MI300X chip focuses on AI inference, offering a cost-effective alternative to Nvidia’s H100. AMD’s participation in the UXL foundation, which aims to create free alternatives to Nvidia’s CUDA, highlights its commitment to challenging Nvidia’s market dominance.

# Intel

Intel is another formidable competitor, with its Gaudi 3 accelerator positioned as a more cost-effective solution for AI inference. Intel’s participation in the UXL foundation and its focus on developing AI chips underscore its competitive strategy.

# In-House AI Chips by Tech Giants

Major tech companies like Amazon, Google, and Microsoft are developing their own AI chips for internal use. This trend could potentially lead to competition between Nvidia and its biggest clients, as these companies seek to reduce their reliance on Nvidia’s chips.

# Startups and Emerging Competitors

Startups like Cerebras Systems and D-Matrix are entering the AI chip market, focusing on different aspects of AI chip design and architecture. These emerging competitors are backed by significant venture capital investments, indicating a growing interest in diversifying the AI chip market.

# Market Outlook

Despite the rising competition, Nvidia remains the dominant player in the AI chip market. Its head start, deep entrenchment of its GPUs and CUDA software, and continuous innovation provide a strong competitive edge. However, the transition from training AI models to inference and the emergence of less expensive alternatives could pose challenges to Nvidia’s market position in the future.

# Conclusion

Nvidia’s journey to a $3 trillion market cap is a remarkable story of innovation, strategic leadership, and market dominance. Jensen Huang’s leadership offers valuable lessons for solopreneurs, emphasizing the importance of embracing failure, authentic leadership, continuous innovation, collaboration, and striving for excellence.

Nvidia’s role in the AI revolution is unmatched, with its GPUs powering some of the most advanced AI applications and driving significant economic and industry impact. While the company faces increasing competition, its strong market position and commitment to innovation ensure that it remains a key player in the AI landscape.

As Nvidia continues to push the boundaries of technology, its journey offers inspiration and insights for entrepreneurs and businesses aiming to achieve similar success. The future of AI and high-performance computing looks promising, with Nvidia leading the charge into new frontiers.

# Resources Section

# Nvidia’s Market Dominance and Financial Performance

-

Nvidia’s Competitive Profile and Market Share

- Nvidia’s market for products is intensely competitive, characterized by rapid technological change and evolving industry standards. The company competes with suppliers and licensors of hardware and software for discrete and integrated GPUs, custom chips, and other accelerated computing solutions, including AI solutions offered by companies like AMD, Huawei, and Intel.

-

Nvidia’s Dominance in the AI Market

- Nvidia’s chips dominate the AI market due to their parallel processing capabilities, versatility, and continuous innovation. Initially designed for gaming, Nvidia’s GPUs have found applications in various domains, including scientific research, autonomous vehicles, and AI. The company’s commitment to innovation has kept it at the forefront of the AI industry.

- Nvidia’s AI accelerators hold between 70% and 95% of the market share for AI chips. The company’s financial performance in May 2024, with a 27% rally pushing its market cap to $2.7 trillion, underscores the soaring demand for its AI processors. Despite strong competition, Nvidia’s head start and deep entrenchment of its GPUs and CUDA software provide a strong competitive edge.

-

- Nvidia’s role in the AI boom is significant, with its chips powering supercomputers and generative AI applications. The company’s A100 GPU chips are used in training models for ChatGPT, and the demand for GPUs is expected to grow as AI systems evolve with more data.

-

- Nvidia briefly surpassed the $3 trillion market cap on the back of the AI boom. The company’s dominance in the AI chip market for data centers, where tech giants invest heavily, has been a significant factor contributing to its growth.

# Nvidia’s Role in AI Growth

-

- Nvidia’s shares have soared due to its unique expertise in GPUs, which excel at rendering images and performing calculations concurrently. The company’s ecosystem, including its software and material sourcing, has positioned it as the go-to source for companies seeking massive computing power for AI needs.

-

Nvidia’s Strategic Shift to AI

- Nvidia’s strategic shift from gaming and graphics GPUs to manufacturing high-performance AI chips has positioned the company at the forefront of the industry. This transition has enabled Nvidia to achieve a $2 trillion market capitalization, making it the first chipmaker to reach this valuation.

-

- Nvidia’s AI contributions include the development of the H100 AI chips, which are up to nine times faster for AI training and 30 times faster for inference than the A100. The company’s continuous innovation and development of critical software pieces have made it a one-stop shop for AI development.

# Leadership Lessons from Jensen Huang

-

Leadership Lessons from Jensen Huang

- Jensen Huang’s leadership style promotes inclusivity, encourages team members to voice opinions, and emphasizes the importance of embracing risks without fear of failure. His commitment to empathy and philanthropy highlights his broader human impact.

-

Jensen Huang’s Leadership Style

- Huang’s leadership style includes having 60 direct reports and rarely firing people. He believes in giving feedback in front of everyone to promote collective learning and improvement. His approach to leadership emphasizes the importance of information flow and empowering people through equal access to information.

-

Jensen Huang’s Leadership Advice

- Huang embraces fear as a motivator and collaborates with his top managers. He believes that failure must be shared and that leaders must always remember the proximity of failure. His leadership advice includes staying the course, embracing ignorance, and sharing failures to foster a culture of learning and improvement.

-

Jensen Huang’s Leadership Insights

- Huang’s leadership insights include the importance of first principles thinking, building deep moats, and nurturing a rich developer ecosystem. He sees AI as the fourth industrial revolution and believes that every country has the right to harness and capitalize on its data to drive economic growth and societal advancements.

# Nvidia’s Competitive Landscape

-

Nvidia’s Competitors and Market Position

- Nvidia faces competition from companies like AMD, Intel, and tech giants developing their own AI chips. Despite this, Nvidia remains the dominant player in the AI chip market due to its head start, deep entrenchment of its GPUs and CUDA software, and continuous innovation.

-

Nvidia’s Market Share and Revenue Growth

- Nvidia’s market share in the GPU market is significant, with the company owning 80% of the GPU market share in Q4 2023. Despite facing competition from Intel and AMD, Nvidia has displayed a higher percentage of revenue growth compared to its competitors over recent years.

-

Nvidia’s Financial Results and Market Impact

- Nvidia’s financial results for the first quarter of fiscal 2025 showed a revenue of $26.0 billion, up 18% from the previous quarter and up 262% from a year ago. The company’s data center growth was fueled by strong demand for generative AI training and inference on the Hopper platform.

-

Nvidia’s Market Cap and Stock Performance

- Nvidia’s market cap surpassed $3 trillion, making it the second most valuable company in the world. The company’s stock has experienced dramatic growth, with shares rising over 3,290% in the past five years. Nvidia’s dominance in the AI chip market has been a significant factor contributing to its growth.

# Additional Insights

-

Nvidia’s Impact on the Tech Industry and Economy

- Nvidia’s success in the AI market has far-reaching implications for the tech industry and the economy. The company’s innovative technologies and focus on pushing the boundaries of what is possible with GPUs have the potential to drive new applications and industries, creating new opportunities for businesses and jobs.

-

Nvidia’s Role in the AI Revolution

- Nvidia’s role in the AI revolution is unmatched, with its GPUs powering some of the most advanced AI applications. The company’s contributions to AI have driven significant productivity gains and cost savings, contributing to economic growth.

-

Nvidia’s Strategic Partnerships and Collaborations

- Nvidia has partnered with tech giants like Amazon, Google, and Microsoft, and has invested in startups to expand its capabilities and market reach. These strategic partnerships have opened new opportunities and driven growth for the company.

-

- Nvidia’s future prospects look promising, with the company poised for its next wave of growth. The Blackwell platform and Spectrum-X open new markets for large-scale AI, and Nvidia’s new software offering, NIM, delivers enterprise-grade, optimized generative AI to run on CUDA everywhere.